Beyond the Short Sale Ban: South Korea's Financial Market Struggles as it Grapples with Crisis

President Yoon Suk Yeol's administration recently implemented a contentious ban on short selling in the stock market (Reuters, 2023). The Financial Services Commission (FSC) has announced plans to utilise the period until June next year to enhance regulations surrounding short selling. Additionally, the government is set to initiate an investigation into "naked" short selling carried out by global institutional investors (Financial Times, 2023).

While banning "naked" short selling aligns with global trends post-financial crisis, South Korea's decision goes beyond this by extending the prohibition to regular short selling. This departure from conventional norms raises eyebrows as regular short selling is considered a healthy mechanism in a robust financial market. It allows investors to hedge their portfolios against potential losses and express bearish views.

Beyond the realm of electoral politics, this move reflects deeper concerns about the financial risks faced by South Korea.

Gloomy Horizons

On a macro scale, the global economy is on shaky ground with the Federal Reserve's interest rate hikes. Across Asia, major currencies are taking a hit. Over the past two years, the Japanese yen has taken a considerable 23.48% dip against the US dollar, while the South Korean won has seen a depreciation of 8.87%,

Figure 1 JPY to USD Chart Source: xe.com

Figure 2 KRW to USD Chart Source: xe.com

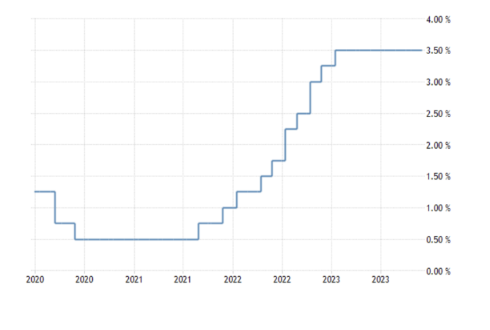

In a bid to prevent a mass exodus of capital to the United States and to cushion against devaluation, South Korea opted to align itself with the interest rate hike trajectory set by the Fed in early 2022. Over a span of two years, the interest rate surged from 0.5% to 3.5%, further compounding the challenges faced by an already beleaguered economy.

Figure 3 South Korea Interest Rate. Source: Trading Economics

Figure 4 United States Fed Fund Interest Rate. Sources: Trading Economics

As an export-oriented nation, South Korea's economic stability is highly susceptible to external influences. Looking at export data, the country's trade deficit continues to widen. After the Fed raised interest rates in 2022, the South Korea trade balance for that year was -$4.50 billion, indicating a 106.94% decrease compared to 2021. (Macrotrend, 2023).

This is partly attributed to subdued consumption in its biggest trading partner China and other Western countries, with global manufacturing PMI persistently below the expansion-contraction threshold.

Moreover, the semiconductor industry, a vital pillar for South Korea, is contending with the challenges brought about by the global semiconductor downturn. Semiconductor-related exports, a substantial factor contributing to the decline in South Korea's overall exports, have been decreasing rapidly since the third quarter of 2022, coinciding with the simultaneous increase in the trade deficit.

Figure 6 South Korea Exports of Semi-Conductor Source: Trading Economics

Figure 7 South Korea Balance of Trade. Source:Trading Economics

Riding the Waves of Speculation

This year,South Korea has been in the spotlight for its financial trouble, ranging from the full rental housing market crisis to the younger generation diving headfirst into the speculative world of crypto currencies.

Beneath the hype of speculative pursuits, there's a prevailing sense among the younger generation that upward mobility in society is a mirage. South Korea's societal framework is frequently scrutinised through the lens of the "spoon class theory," where individuals are categorised into various socioeconomic classes determined by their parents' financial standing (The Korea Times, 2023) .

Figure 8 Spoon Class Theory in Korea

The well-trodden path laid out by society for South Koreans includes excelling in high school, securing admission to a prestigious SKY university – an acronym representing the three most esteemed institutions in Korea: Seoul National University, Korea University, and Yonsei University, entering one of the major chaebols, and gradually climbing the corporate ladder.

For the youth caught in a seemingly predetermined narrative with dwindling hope, the gamble shifts to speculative adventures like cryptocurrency and stocks. Recent financial theatrics, from crypto plunges to the GME and Tesla's stock rollercoaster, have witnessed the spirited participation of South Korea's retail investors, predominantly among the younger demographic.

South Korea, with less than 1% of the world's population, has generated over 20% of global cryptocurrency trading volume. Among the 6.27 million users actively participating in cryptocurrency trading at the end of 2022, those aged between 20 and 49 accounted for 79% (Liu&Luo, 2023). This surge in cryptocurrency activity is coupled with a rising trend in South Korea's household debt to gross disposable income ratio (188.2% in 2019 to 203.7% in 2022). Notably, many youth borrow money to finance their investments, raising concerns about a potential debt crisis.

Figure 9 Sources: statista

The allure of speculative pursuits among the youth paints a vivid picture of economic lethargy and a horizon seemingly void of growth opportunities. This is underscored by the fact that South Korea has the world's lowest birth rate, the lowest happiness index and the highest average working hours among OECD countries (The Korea Herald, 2023) .

The Melting Snowball

Another potential crisis lay in the housing market. Unlike the conventional rental model where tenants pay monthly rent to landlords, in South Korea the full rental system, known as chonsei(전세), involves tenants paying a lump sum of 40%-60% of the house's value and receiving it back at the end of the contract period(Chicago Booth Review, 2023) . For young people dependent on renting housing, chonsei often proves to be more economical. This is due to the low-interest rate loans offered by banks under the chonsei scheme, resulting in monthly interest payments that are more affordable than traditional rental costs. However, this seemingly advantageous mechanism has a critical flaw.

Consider a scenario where a property worth 900 million won is rented out, and the landlord immediately receives 540 million. This income can be utilised to pay off existing mortgages and finance the acquisition of new properties, enabling landlords to speculate and build substantial real estate portfolios without requiring initial capital (Chicago Booth Review, 2023). Essentially, tenants, instead of paying monthly rent, end up providing landlords with interest-free loans.

This model triggers high leveraged speculative activities. In a prominent case dubbed the "apartment king" in Korea, a man in his 40s acquired over 1,000 units in low-rise buildings in and around Seoul, leveraging the often-used strategy of using chonsei deposits to fund the purchase (Korea JoongAny Daily, 2023).

Figure 10 President Yoon Suk Yeol shakes hands with former President Park Geun-hye during a ceremony to commemorate the 44th anniversary of the death of Park's father, former President Park Chung-hee, at the Seoul National Cemetery in Dongjak District, Thursday. Joint Press Corps Sources: The Korea Timese

However, behind the scenes of the full rental extravaganza, there are underlying conditions; it depends on the premise of low-interest rates, enabling housing prices to climb. Yet, when interest rates increase, mortgage rates surge, putting pressure on the monthly payments for chonsei clients. As a result, tenants found the chonsei option unfavourable comparable to the rental house. Landlords, deprived of their income sources, now grapple with a looming crisis of defaults, turning this housing tale into a captivating saga of financial suspense.

The leader

The current president, Yoon Suk Yeol, emerges as an opportunist lacking strategic resilience. His tendency to waver in political stances has been evident since the inception of his candidacy.

After Moon Jae-in claimed the presidential set in 2017, Yoon initially aligned himself with the left-wing camp and was appointed as the Chief Prosecutor of the Seoul Central District Prosecutors' Office. Renowned for his ruthless and swift handling of cases, he earned the name "Presidential Assassin" by sanctioning former Presidents Park Geun-hye and Lee Myung-bak in quick succession from 2017 to 2018 (The Guardian, 2018). However, he swiftly shifted his political allegiance. After a political break with Moon, Yoon began aligning himself with right-wing camps, participating in the presidential election in 2022 to represent them.

Following the release of Park Geun-hye from prison, a situation in which Yoon himself played a role in her imprisonment. Yoon's interactions with her intensified, signalling a seeming alliance between them. This move, seemingly born out of necessity due to Yoon's dwindling approval ratings at the coming election, was an attempt to garner support from the conservative camp by "joining hands with Park Geun-hye." (Korea JoongAny Daily, 2023)

Figure 10 President Yoon Suk Yeol shakes hands with former President Park Geun-hye during a ceremony to commemorate the 44th anniversary of the death of Park's father, former President Park Chung-hee, at the Seoul National Cemetery in Dongjak District, Thursday. Joint Press Corps Sources: The Korea Timese

The instability in the South Korean government has the potential to reverberate into financial policy stability. Yoon, contrary to Moon's housing policies, reversed strategies aimed at curbing housing prices, despite the foreseeable issues associated with the full rental housing model during Moon's administration.

In sum, amid the surge in interest rates, South Korea's macroeconomy faces setbacks exacerbated by internal governmental instability. Formulating enduring policies to tackle systemic risks in the financial sector and societal issues proves challenging. The disillusionment of youth, contributes to a pervasive speculative atmosphere and a skyrocketed debt ratio. The eruption of a chonsei debt crisis adds to the complexity, signalling the subtle yet discernible movement of financial thunderstorms on the horizon.

Bibliography

Ahn, A. (2023) 'South Korea has the world's lowest fertility rate, a struggle with lessons for us all'. NPR, 19 March. Available at: https://www.npr.org/2023/03/19/1163341684/south-korea-fertility-rate (Accessed: 11 December 2023).

Choi, S. J. (2023) 'Spoon Class Theory' gains force in Korea. The Korea Times. Available at: https://www.koreatimes.co.kr/www/tech/2023/11/129_191159.html (Accessed: 11 December 2023).

Davies, C., Song, J., Lockett, H. (2023) 'Global banks criticise South Korean short selling ban as ‘phantom farce’'. Financial Times, 16 November. Available at: https://www.ft.com/content/1dd9b025-9007-401e-9010-ebc083e67a38 (Accessed: 11 December 2023).

Haas, B. (2018) 'Former South Korean president jailed for 15 years for corruption'. The Guardian, 5 October. Available at: https://www.theguardian.com/world/2018/oct/05/south-korean-president-jailed-15-years-corruption-lee-myung-bak (Accessed: 11 December 2023).

Kim, S. (2023) 'Yoon reunites with ex-President Park after 12 days, this time in Daegu'. Korea JoongAng Daily, 7 November. Available at: https://koreajoongangdaily.joins.com/news/2023-11-07/national/politics/Yoon-reunites-with-exPresident-Park-after-12-days-this-time-in-Daegu/1907886 (Accessed: 11 December 2023).

Lee, J. (2023) 'S.Korea to bring retail short-selling rules in line with institutions'. Reuters, 16 November. Available at: https://www.reuters.com/markets/south-korea-keep-stock-short-selling-ban-until-market-improves-regulator-2023-11-16/ (Accessed: 11 December 2023).

Liu Rongrong, Luo Laikuan (2023) '剪不断、理还乱的韩国炒币热潮'. 中国周边. China Academic Journal Electronic Publishing House. Available at: http://www.cnki.net (Accessed: 11 December 2023).

MacroTrends (2023) 'South Korea Trade Balance 1960-2023'. Available at: https://www.macrotrends.net/countries/KOR/south-korea/trade-balance (Accessed: 11 December 2023).

Min-ji, J. (2022) 'Death of Korea's 'apartment king' leaves 100s in property purgatory'. Korea JoongAng Daily, 15 December. Available at: https://koreajoongangdaily.joins.com/2022/12/15/business/economy/korea-apartment-property/20221215162841416.html (Accessed: 11 December 2023).

Doris, Á. (2023) 'Why South Korea’s Housing Market Is So Vulnerable'. Chicago Booth Review - Economics, 6 June. Available at: https://www.chicagobooth.edu/review/why-south-koreas-housing-market-is-so-vulnerable (Accessed: 11 December 2023).

Pictures

South Korea Exports of Semi Conductor (tradingeconomics.com)

https://www.koreatimes.co.kr/www/tech/2023/11/129_191159.html

Yoon vows to revive spirit of ex-president Park Chung-hee - The Korea Times

Note that opinions expressed in the article above do not necessarily represent the overall stance of Asiatic Affairs, Students' Union UCL or University College London. If you have read something you would like to respond to, please get in touch with uclasiaticaffairs@gmail.com.

Want to write for us? Don’t worry about experience - we are always looking for writers interested in Asiatic affairs. Submit your ideas at https://forms.gle/koQbsExb6XsAy1Tk6 and we’ll get in touch.